Pierce wishes to purchase a municipal bond – Pierce’s desire to purchase a municipal bond brings to the forefront an opportunity to delve into the intricacies of this investment vehicle. This guide will provide a comprehensive overview of the municipal bond market, its characteristics, and strategies for evaluating and selecting suitable bonds.

By exploring Pierce’s financial situation, risk tolerance, and investment goals, we will navigate the complexities of municipal bond investing and empower Pierce with the knowledge to make informed decisions.

The following sections will delve into the nuances of municipal bonds, from understanding their tax-advantaged nature and credit ratings to assessing yields and spreads. We will also discuss the process of purchasing and managing municipal bond investments, ensuring that Pierce is equipped with the necessary knowledge to navigate this market effectively.

Pierce’s Investment Goals and Risk Tolerance

Pierce is considering purchasing a municipal bond to diversify their investment portfolio and potentially generate tax-free income. Their financial situation includes a stable income, a moderate amount of assets, and minimal liabilities.

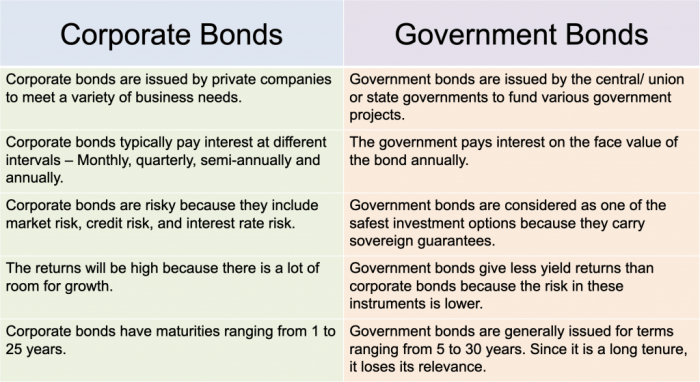

Pierce has a moderate risk tolerance, meaning they are comfortable with some level of investment risk but prioritize preserving capital. Municipal bonds align with this risk tolerance due to their typically lower volatility and stable interest payments.

Municipal Bond Market Overview

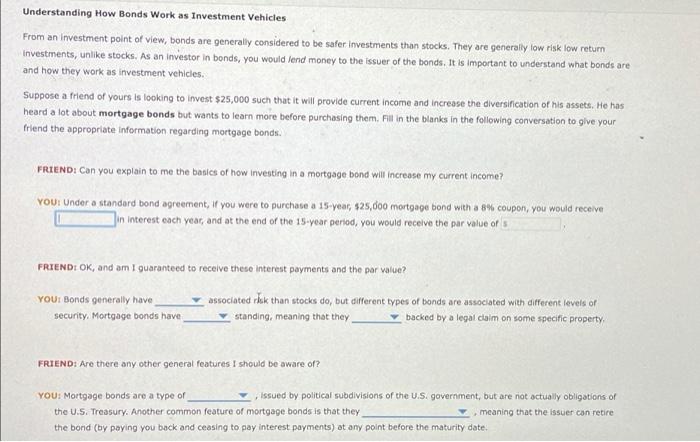

The municipal bond market is a vast and complex landscape that encompasses various types of bonds issued by state and local governments, as well as their agencies and authorities. These bonds are exempt from federal income tax and may offer tax advantages at the state and local levels.

Key features of municipal bonds include credit ratings, which assess the issuer’s ability to repay debt; maturities, which determine the bond’s lifespan; and yields, which represent the annual return on investment.

Current market conditions and trends can influence the attractiveness of municipal bonds as an investment option. Factors such as interest rate changes, economic conditions, and political developments can impact bond prices and yields.

Evaluating Municipal Bonds

Evaluating municipal bonds requires careful consideration of several key factors. These include:

- Creditworthiness of the issuer: Assessing the issuer’s financial health, debt burden, and management practices.

- Bond yield and spread: Comparing the bond’s yield to similar bonds and understanding the spread or difference in yield.

- Maturity and call features: Considering the bond’s maturity date and any potential call features that may allow the issuer to redeem the bond before maturity.

Selecting Municipal Bonds

Selecting municipal bonds that align with Pierce’s investment goals requires a tailored approach. Strategies may include:

- Diversification: Spreading investments across different issuers, sectors, and maturities to reduce risk.

- Credit quality: Prioritizing bonds with higher credit ratings to enhance stability and reduce default risk.

- Yield and maturity: Balancing the desired yield with the appropriate maturity to meet Pierce’s income and investment horizon needs.

Purchasing Municipal Bonds: Pierce Wishes To Purchase A Municipal Bond

Purchasing municipal bonds involves working with a broker or dealer who facilitates the transaction. The process includes:

- Placing an order: Specifying the desired bond, quantity, and price.

- Settlement: Completing the transaction and transferring ownership of the bond to Pierce.

- Associated costs: Incurring fees for brokerage services and potential transaction costs.

Monitoring and Managing Municipal Bond Investments

Once purchased, monitoring and managing municipal bond investments is crucial. This includes:

- Tracking performance: Monitoring bond prices and yields to assess the investment’s progress.

- Managing interest payments: Receiving regular interest payments and reinvesting or using them for income.

- Reacting to market changes: Adapting the investment strategy as market conditions evolve to preserve capital and generate returns.

Detailed FAQs

What are the benefits of investing in municipal bonds?

Municipal bonds offer several benefits, including tax-exemption, potential for stable income, and diversification opportunities.

How do I evaluate the creditworthiness of a municipal bond issuer?

Assessing the creditworthiness of a municipal bond issuer involves examining factors such as their financial health, debt burden, and management team.

What is the process for purchasing municipal bonds?

Purchasing municipal bonds typically involves working with a broker or dealer who can facilitate the transaction and provide guidance.